Banks, ironically, aren’t the most tech-forward companies in the world. Often developments like mobile banking and electronic payments have been slow to catch on. Now a wholly new approach to banking has emerged: GoBank from Green Dot a bank designed from end to end for the mobile user.

And not just the mobile user, but young mobile users.

According to their press release GoBank offers the following features (almost makes it sound like software):

- Debit Card Customization: Members can personalize GoBank by customizing the entire front of their Visa® debit card with their favorite photo. They can choose the picture from Facebook, their phone or computer.

- Should You Buy It? Ask the Fortune Teller: “Remember that time you won the lottery? I don’t either.” This is a response a member might see from GoBank’s Fortune Teller if they try to spend beyond their budget. Fortune Teller cross-checks the price of an item with the member’s integrated GoBank budget, and if they can’t afford it they’ll be advised in real-time to pass on the purchase. The budget tool is fun for members to use, with tons of responses that aim to entertain as well as inform.

- Huge Fee-Free ATM Network: Members can withdraw cash from more than 40,000 fee-free ATM locations in the U.S. As a market comparison, Chase and Bank of America each have less than 20,000 fee-free ATMs. [2]

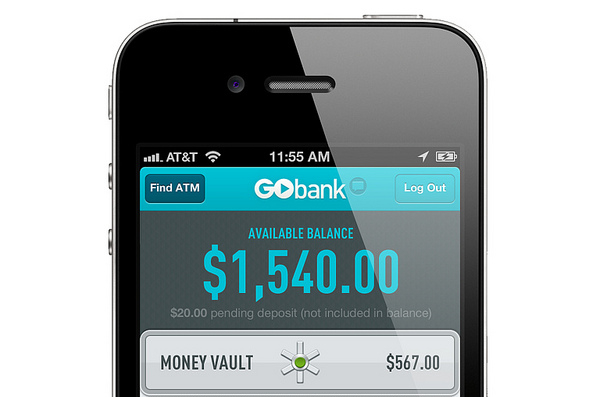

- Peek at Your Balance Without Logging In: The #1 reason a person logs into their bank account is to check their balance. GoBank allows members to use “Slide for Balance” on the app’s login screen to take at peek at their available balance without logging in (members opt into this feature).

- Send Money: Members can instantly send money to friends and family at no charge through email, text message or even a private Facebook notification. Recipients don’t have to be GoBank members to receive the money.

- Quick Account Set-Up: Compared to typically long processes associated with opening a traditional bank account, setting up a GoBank account can take just minutes. This includes the time it takes to create an optional custom Visa debit card with a member’s own photo.

- Multiple Deposit Options: GoBank has a variety of ways to deposit money into the account. Members can deposit checks by snapping a photo through the app, and they can use a debit card to transfer some money from another bank account. Direct deposit is available for paychecks, federal benefits or tax returns. Lastly, members can deposit cash at select Green Dot retail partner locations nationwide – all for free.

- Mobile Checkbook and Bill Pay: Members can pay any company or any person online or on their phone, and GoBank will mail a paper check to any recipient that doesn’t accept e-payments.

- Money Vault: The Money Vault is an integrated bank account, with deposits insured by the FDIC, where members can easily put money away for savings. In real time, members can move money from their checking account available balance into the Money Vault for safe keeping. When they want to spend that money, the member can move it back in two taps and it updates their available balance in real time. The Money Vault is free to use and members can move money back and forth as often as they wish.

- Robust Account Alerts: Members can fine-tune a wide range of notifications about their money to fit their needs – with alerts about specific transactions, as well as overall account updates.

This is a real bank (based on acquiring a Utah bank in 2011) with deposits that are FDIC insured. I tried the virtual bank concept for a while (that is a bank without physical branches) with President’s Choice Financial in Canada. I found it convenient, mostly, until I needed something like a cashier’s check or something. However that was a decade ago and banks have come a long way since then. If it were available in Canada I might be tempted by a mobile-friendly bank like this.

Speaking of banks and banking, Green Dot also released this infographic on the “State of Banking”, which is pretty interesting in its own right:

HT: AllThingsD and VentureBeat.