Last year Apple introduced the much-awaited Apple Card with unique features like daily cashback and exclusive cashbacks with Apple partners. Today Tim Cook announced Apple Card Family at Spring Loaded event.

Apple agrees to the lack of fairness credit score is usually calculated. Jennifer Bailey, VP of Apple Pay, says, “We designed Apple Card Family because we saw an opportunity to reinvent how spouses, partners, and the people you trust most share credit cards and build credit together. There’s been a lack of transparency, and consumer understanding in the way credit scores are calculated when there are two users of the same credit card since the primary account holder receives the benefit of building a strong credit history while the other does not.

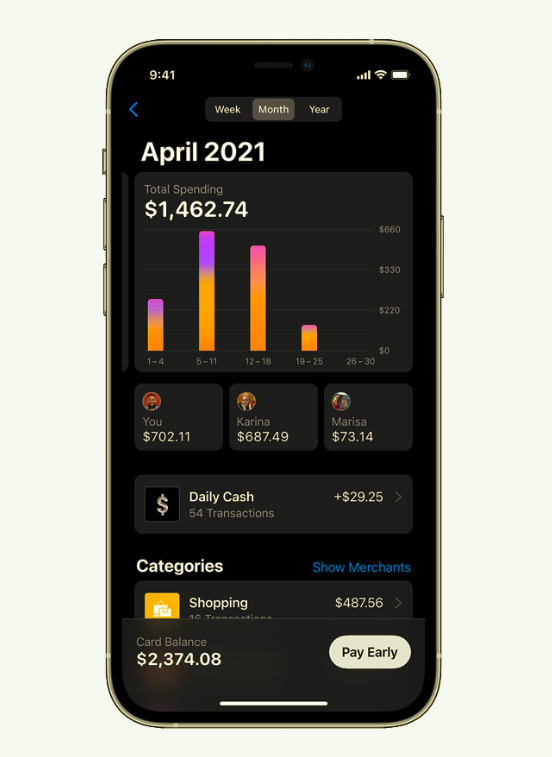

Apple Card Family allows spouses to combine their credit line and credit score. Furthermore, Apple Card Family allows anyone in the family over the age of 18 to use the card. It is also designed to help family members build a credit score and track all the spending on the iPhone. At the end of the billing cycle, the entire family will get a single monthly bill. Typically the primary account holder of a credit card gets the benefit of building a credit score. However, with the Apple Card Family, both the primary cardholder and their spouse will reap the benefit.

To use Apple Card Family, all the users should be part of the Family Sharing group. The co-owner of the card should be 18 years or older. Meanwhile, anyone who is 13 years of age and above can be assigned an individual spending limit. This way, the kids will learn how to manage their expenses independently while parents can keep a tab on their spending. The only downside is that if co-owners credit history.