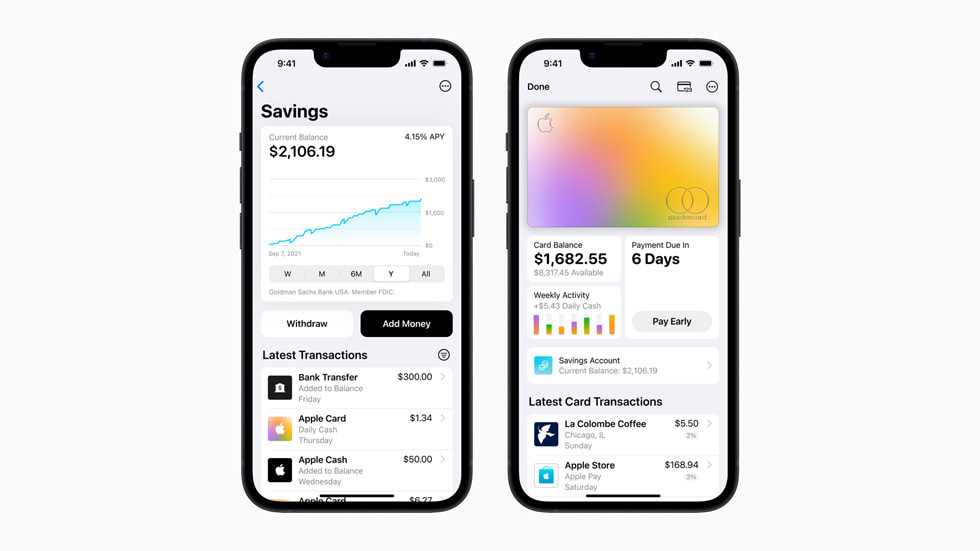

Apple today announced a savings account feature for its Apple Card users. This savings account offers an impressive APY of 4.15% with no fees, no minimum deposits, and no minimum balance requirements.

Apple first announced the savings account feature in October 2022, and it has now been made available. Apple says it aims to make saving money more accessible and convenient for its users.

The Apple Savings account allows users to deposit Daily Cash rewards earned from using the Apple Card or personal funds from a linked bank account or Apple Cash balance into high-yield savings account through the Wallet app.

To sign up for Apple Card Savings, users can access the Wallet app on their iPhone, tap on their Apple Card, tap the three dots in the upper-right corner, and select “Daily Cash.” Once set up, all incoming Daily Cash will be deposited automatically, earning interest immediately.

If users prefer, they can add their Daily Cash to their Apple Cash balance at any time. Users can also track their account balance and interest earned over time through a dashboard in the Wallet app.

Jennifer Bailey, Apple’s Vice President of Apple Pay and Apple Wallet, says the new feature aims to help users lead healthier financial lives. With this new feature integrated into the Apple Card in Wallet, users can now spend, send, and save Daily Cash directly and seamlessly, all from one place.

The feature is now available to all US residents who are 18 or older. The feature requires an iPhone with iOS 16.4 or later.

Source: Apple